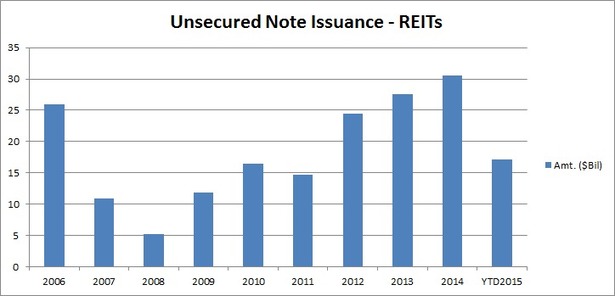

This year, real estate investment trusts (REITs) have raised $17.1 billion of capital through the sale of unsecured notes, bringing the total raised over the past two and a half years to just more than $75 billion. That is more than they raised during the previous five years.

The massive volume should not be a surprise since it comes while the yield from ten-year Treasury bonds—the benchmark against which most REITs price their bonds—has ranged from 1.66 percent to 3.04 percent during the past 30 months.

The low risk-free rates have allowed REITs to issue ten-year bonds with coupons as low as 2.75 percent during that period. That was done by Federal Realty Investment Trust, which has a Baa1 rating from Moody’s Investors Service and A- ratings from Standard & Poor’s and Fitch Ratings.

Source: urbanland.uli.org

Real Estate Investment Trusts (REITs) have raised $17.1 billion of capital through the sale of unsecured notes, bringing the total raised over the past two and a half years to just more than $75 billion. That is more than they raised during the previous five years.

REITs have faced challenges in finding suitable acquisition targets. In fact, some REITs are saying they are likely to become sellers, as opposed to buyers, because property values are so high. That could very well temper their need to borrow through the unsecured debt market.